In brief

- PancakeSwap is a decentralized exchange (DEX) similar to Ethereum’s Uniswap, except that it runs on Binance Smart Chain(BSC).

- With the DEX, you can trade tokens without an intermediary, enter a lottery, earn liquidity pool and staking rewards, and more.

Unlike centralized cryptocurrency exchanges like Binance and Coinbase, which are operated by a single corporate entity, decentralized exchanges (DEXs) allow trading without the involvement of any third party. Such DEXs are largely based on Ethereum, where most decentralized finance (DeFi) action takes place.

Similar decentralized exchanges are emerging elsewhere, sometimes with distinctive features, as rival smart contract blockchains take hold. PancakeSwap runs on Binance Smart Chain as opposed to Ethereum, and as a result, it offers significantly lower trading fees. Even though Binance Smart Chain is newer and less established than Ethereum, PancakeSwap is already making waves among DEXs.

The following is a quick primer on how to go about using PancakeSwap on the Binance Smart Chain.

What is PancakeSwap?

Using PancakeSwap, you are able to trade cryptocurrencies and tokens without a centralized intermediary, while still keeping custody of your tokens. The project is built on Binance Smart Chain, the blockchain-based platform run by the crypto exchange Binance.

While Binance does operate a centralized exchange service, it does not own or operate PancakeSwap, which was developed by anonymous developers. This service looks and feels a lot like the Ethereum DEX, Uniswap. Currently, PancakeSwap is reserved for BEP-20 tokens on Binance Smart Chain, although it is possible to bring over tokens from other platforms via Binance Bridge and “wrap” them as BEP-20 tokens for use on the DEX.

PancakeSwap, like most DEXs, relies on an automated market maker (AMM) system to facilitate crypto trades. Instead of going through an order book and trying to find someone who wants to swap the tokens you have for the ones you want, smart contracts allow users to lock their tokens into a liquidity pool. This allows you to swap coins to make the best deal while keeping your coins in the pool earns you rewards.

PancakeSwap represents the rising wave of DeFi services that allow traders to conduct transactions with trade tokens without a middleman taking a substantial cut. The Binance Smart Chain DEX is one of the largest of its kind, although there are DEXs on Ethereum (such as Uniswap) that have significantly higher average trading volumes.

Did you know?

PancakeSwap has flipped Uniswap on multiple occasions to become the most popular DEX based on trading volume but hasn’t consistently maintained that title as of yet.

How does PancakeSwap work?

A token swap takes place through liquidity pools between two token pairs as described above. The liquidity pools allow users to exchange one type of token for another without a third party, while other users who stake their tokens earn a share of the rewards generated by transactions.

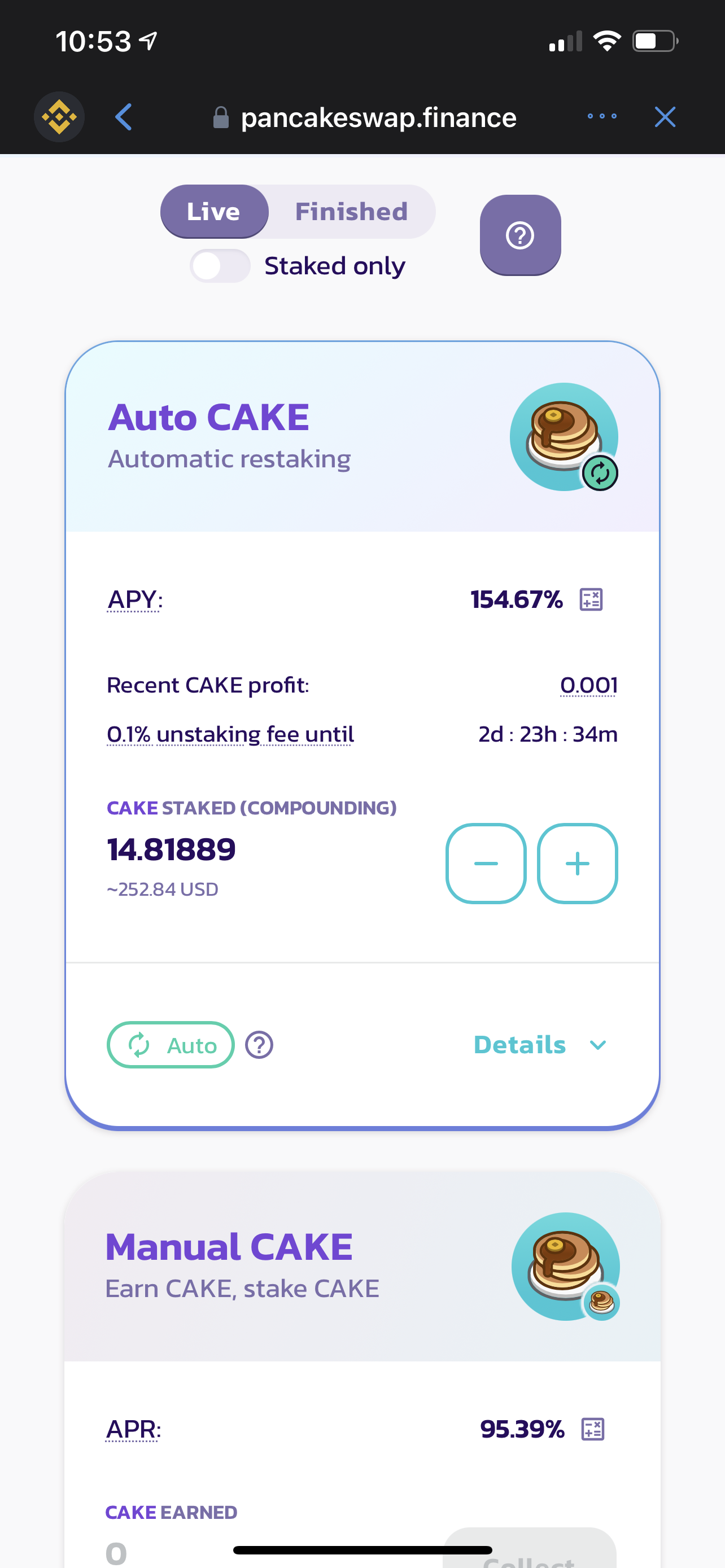

However, PancakeSwap is much more than just that. Additionally, the DEX allows users to stake coins into so-called Syrup Pools that provide increasing rewards. As an example, you can stake CAKE, PancakeSwap’s native token, and earn even more CAKE when you let it sit there in the Syrup Pool for a period of time. There’s a feature that automatically re-stakes your CAKE every hour, continually compounding your rewards.

PancakeSwap offers game-like experiences, such as wagering on whether the price of Binance Coin (BNB) will rise or fall within a limited window of time. It also has a lottery feature that lets users buy a ticket in hopes of winning a major windfall of CAKE, plus the DEX offers a wide array of bunny-themed collectible non-fungible tokens (NFTs) to purchase. There are also Initial Farm Offering (IFO) sales that let you buy brand new coins from budding projects.

Did you know?

PancakeSwap is the latest in a long line of food-themed crypto projects, including SushiSwap, Yam Finance, BakerySwap, and Kimchi Finance.

High Yield Rewards With PancakeSwap

PancakeSwap cuts out the middlemen of centralized exchanges, letting other users reap the rewards instead. If you’re willing to lock up your tokens for a while, the rewards can be very plentiful, particularly with some of the liquidity pools and staking options.

Granted, as with other DEXs, crypto newbies will likely struggle to navigate PancakeSwap and understand its myriad features. It could be worth your while to take the time to figure it out, though.

Tutorial : How to use PancakeSwap on Trust Wallet

You will need your own crypto wallet to use PancakeSwap, as the DEX does not support fiat currency. PancakeSwap works with wallets such as Trust Wallet, MathWallet, Binance Chain Wallet, and even MetaMask. Yes, MetaMask is an Ethereum wallet, but it can be configured to work with Binance Smart Chain. Unlike centralized exchanges, you won’t have to input a bunch of personal data—you don’t even have to create a profile.

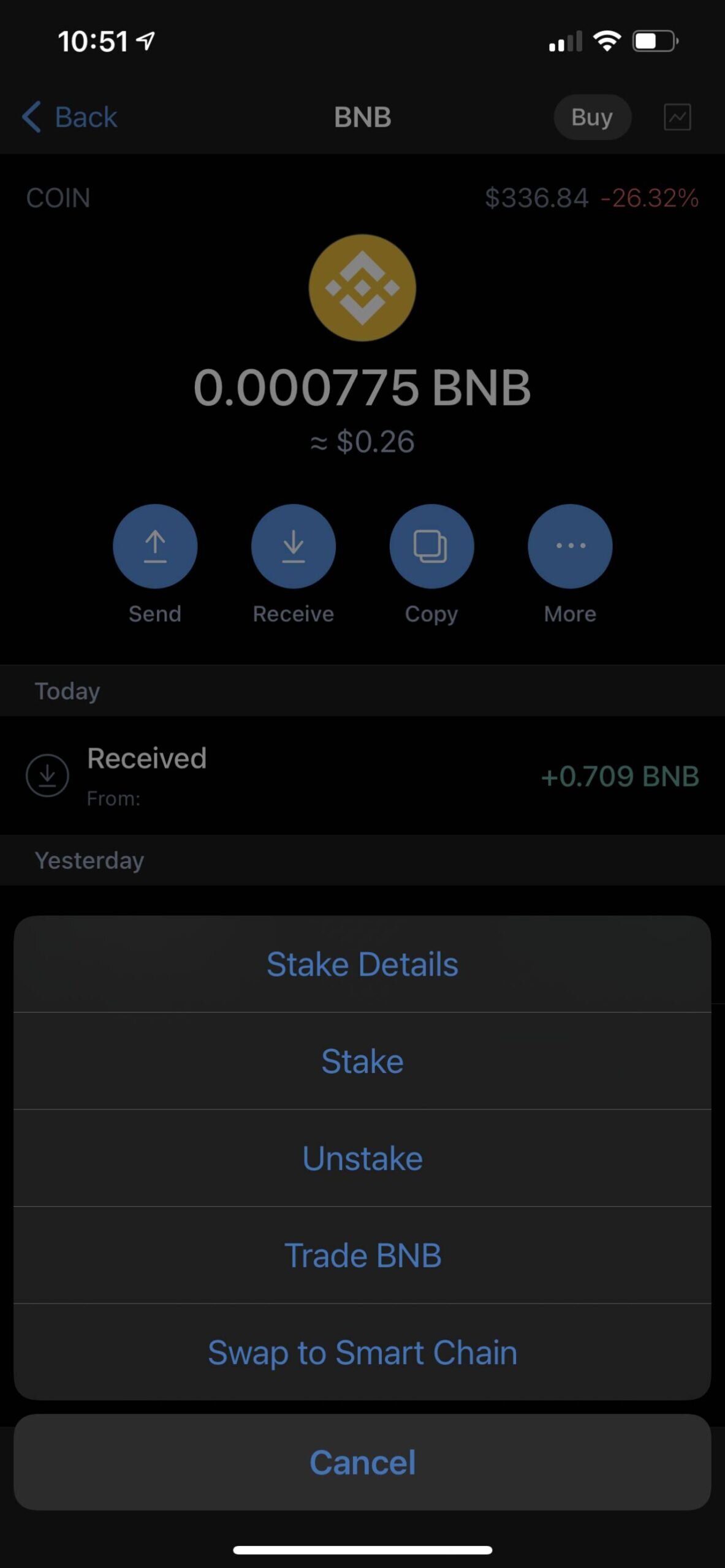

PMACrypto opted to use Trust Wallet on a smartphone. The first step is to purchase some Binance Coin (BNB) from Binance.US and transfer it to your wallet. Then you’ll need to convert it to Binance Smart Chain to use it at PancakeSwap. You can do that within Trust Wallet by pressing the “More” button, tapping “Swap to Smart Chain,” and paying a small transaction fee to convert your coins.

All of PancakeSwap’s functions are shown on the left side of the screen in your web browser. To swap tokens, go to Trade and select Exchange, and then choose which token in your connected wallet you want to trade, for which supported token on the DEX. You will need to confirm the transaction within your wallet to execute it.

For farms, or liquidity pools, you must spend an equal value of tokens in a pair (such as CAKE-BNB) to purchase LP tokens, which provide liquidity to the DEX and earn you rewards in the process. This liquidity can be removed at any time, and will be disbursed in the individual tokens that were initially swapped for the LP tokens.

The Future of Pancake (CAKE Coin) – Is It Worth Your Investment In 2022?

Binance Smart Chain is growing quickly as developers take advantage of its low fees and speedier transactions compared to Ethereum. In April 2021, Binance revealed that the platform had executed some 4.9 million transactions in a single day, or three times the amount that Ethereum has ever managed in a day.

PancakeSwap doesn’t have the same level of average daily volume as Uniswap or SushiSwap, Ethereum’s two biggest heavyweight DEXs, but it’s already very popular considering the relatively young age of Binance Smart Chain.

If Binance’s decentralized app (dapp) platform continues to grow and pull in more developers and users alike—and Ethereum’s soaring gas fees and network congestion continue—then PancakeSwap may well put up an even stronger fight against rival exchanges in time.

Via this site